Green Bond(Eighth Series of Unsecured Straight Bonds)

ーUtilizing ESG Finance for the Realization of an Environmentally Harmonious Societyー

Rationale for Issuance of Green Bond

Toward a sustainable society, addressing climate change has become a global challenge. The JGC Group defines "Societies in harmony with environment" as a materiality, and is working to develop projects and technologies that contribute to low-carbon and decarbonization. The Group has launched several green projects so far, and has decided to utilize green bonds as a means of raising funds for such projects. We believe that the issuance of green bonds will demonstrate the Group’s value-creation efforts to create economic, social and environmental value by steadily promoting green projects and solving social issues through business activities, to a wide range of stakeholders, including investors.

Green Bond Framework

JGC has established a "Green Bond Framework" for the issuance of Green Bonds.

Products and projects that contribute to the realization of "carbon-neutrality" and a "recycling-oriented society" are defined as eligible projects for Green Bonds.

Outline of Green Bond

| Issuing entity | JGC Holdings Corporation |

|---|---|

| Corporate bond name | Eighth Series of JGC Holdings Corporation Unsecured Straight Bonds (With Inter-bond Pari Passu Clause)(Green Bond) |

| Term of Issue | 5 years |

| Amount of issue | 10 billion yen |

| Interest rate | 0.603 % |

| Date of Issue | September 19, 2023 |

| Date of redemption | September 19, 2028 |

| Use of funds |

|

| Corporate bond rating | A+(Japan Credit Rating Agency, Ltd.(JCR)) |

| Lead managing broker | Nomura Securities Co.,Ltd., SMBC Nikko Securities Inc., Daiwa Securities Co. Ltd., Mizuho Securities Co., Ltd. |

Introduction of Green Projects

SAF(Sustainable Aviation Fuel)

Sustainable Aviation Fuel (SAF) is expected to significantly reduce greenhouse gas emissions compared to conventional aviation fuel throughout its life cycle, from the production and collection of raw materials such as biomass, waste cooking oil, and municipal waste, to manufacturing and combustion, as well as being capable of utilizing existing infrastructure. Through the commercialization, diffusion, and expansion of domestically produced SAF, the Minebea Group aims for the development of Japan's aviation network and industry as a whole, as well as the realization of a sustainable society.

Bio manufacturing

Biomanufacturing is an initiative to develop recycling-oriented manufacturing without relying on fossil resources through the improvement of microorganisms to produce chemicals such as bioplastics and functional materials, fuels, and foods (such as protein and feed) from raw materials such as sugar and CO2.

- Related Release ”Development of Polymer Synthesis Technology by Microorganisms using CO2 as Direct Raw Material" selected as a NEDO Green Innovation Fund Project”[PDF:468KB]

- Related Release ”JGC HD and Bacchus to Jointly Promote Integrated Biofoundry® Business for the Growth Market of Biomanufacturing”[PDF:391KB]

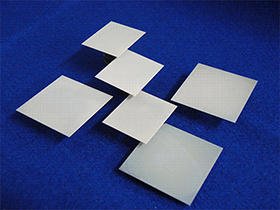

High Thermal Conductivity Substrates

The global trend toward decarbonization is accelerating the shift to electric vehicles (EVs). Japan Fine Ceramics, a JGC Group company, develops, produces, and sells insulated heat-dissipating ceramic substrates for power semiconductors that control the power of various devices required for power-saving EVs. Through the production of highly thermally conductive silicon nitride substrates with better thermal conductivity and insulation than conventional products, the performance of power semiconductors is expected to improve and popularize their use, leading to energy conservation in high-speed railroads and industrial equipment as well as the expansion of the use of EVs.

Third-party evaluation of eligibility

Second Party Opinion

A third-party evaluation of the Framework's conformity with the "Green Bond Principles (GBP) 2021" and the "Green Bond Guidelines 2022" has been obtained from Rating and Investment Information, Inc.

Ministry of the Environment's FY2023 Market Infrastructure Development Support Project for Expanding Green Finance

The acquisition of the third-party evaluation for these Green Bonds results in eligibility for a subsidy under the Ministry of the Environment‘s FY2023 Market Infrastructure Development Support Project for Expanding Green Finance *

- *FY2023 Subsidy for carbon dioxide emission control projects / global environment conservation measures(Market Infrastructure Development Support Project for Expanding Green Finance)

- 1.At least 50% of the amount of funds raised must be allocated to domestic decarbonization projects

- 2.Confirmation of the Green Bond Framework's compliance with the Green Bond Guidelines by an external review organization prior to issuance.

- 3.Avoidance of so-called "greenwash bonds".