Climate Change Initiatives

Basic Stance

As we work toward a sustainable society, addressing climate change has become a global challenge. JGC Group has identified "societies in harmony with the environment" as a materiality. Besides taking climate action through environmentally conscious business activities, the JGC Group studies and formulates business strategies accounting for scenario analysis in recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Climate change related disclosure

In participating in international frameworks for climate change disclosure, the JGC Group has responded to CDP surveys since 2021 (when the Group received a B rating in fiscal 2024) and has followed TCFD disclosure guidelines as a supporter, including securities reports.

For further information, refer to JGC's CDP Climate Change 2024 Response[PDF:1.18MB].

| Governance | Through the Sustainability Committee chaired by the CEO, Representative Director, our Group is responsible for evaluating and managing climate- related risks and opportunities, as well as incorporating these into the Group's management strategies and objectives. | |

|---|---|---|

| Strategy | Based on both the risks and opportunities associated with climate change, and the results of scenario analysis, we are reflecting these out- comes in our management strategies, such as the 2040 Vision. | |

| Risk Management | We have separately established the Group Risk Management Committee, chaired by the Representative Director, President and COO to identify and manage the Group's overall risks including sustainability risks related to climate change, to maintain and build the risk management system, and to discuss and deliberate on improvements. | |

| Metrics and Targets | In 2021, the JGC Group announced our "Commitment to Carbon |

Governance

The JGC Group responds to climate change issues under the leadership of the representative director and CEO, who is responsible for ensuring that environmental issues are addressed in Group business strategies and targets. One facet of this is assessing and managing climate-related risks and opportunities. Accordingly, the long-term management vision and medium-term business plan announced in May 2021 were established through Board discussions based in part on results of climate change scenario analysis and an assessment of these risks and opportunities. Monitoring of climate change issues is conducted by the Sustainability Committee, which formulates policies and action plans related to sustainability, including the Group response to climate change, and deliberates to evaluate and promote relevant action.

Strategy

The JGC Group recognizes risks and opportunities related to climate change, which are reflected in strategies.

Recognition of Climate-Related Risks and Opportunities

| New regulatory risks | The introduction of carbon taxes and carbon emissions targets in various countries may lead to higher equipment and fuel costs, which may affect business costs in the future. The introduction of carbon taxes and stricter emission targets in various countries also poses a risk of fewer contract opportunities, from a decline in oil & gas projects. |

|---|---|

| Technology risks | Lower gasoline demand from the spread of electric and fuel cell vehicles poses a risk of fewer contract opportunities for plants in the oil & gas industry. A similar risk is posed by the spread of decarbonized materials and a shift to renewable energy driven by the spread of high-performance storage batteries. |

| Regulatory risks | Firms bidding on plant construction projects are likely to face stricter information disclosure requirements regarding their climate change measures. This poses a risk of lost opportunities or unsuccessful bids, which may affect the corporate reputation. |

| Market risks | Lower plant demand in the oil & gas industry may result in fewer contract opportunities. An aversion in financial and capital markets to business related to fossil fuels also poses a risk that projects may not be approved. |

| Policy and legal risks | Failure to maintain or build on our reputation as an enterprise with the technical expertise to contribute to climate change solutions such as carbon reduction, renewable energy, and hydrogen applications may adversely affect the JGC Group in various ways, such as contract opportunities, financing, or securing human resources. |

| Acute physical risks | More frequent extreme weather events such as heavy rain, storms, typhoons, and flooding attributed to climate change may physically damage materials, equipment, and JGC Group facilities, adversely affect employees, and delay procurement. |

| Chronic physical risks | Higher average temperatures may make longer construction periods more common, due to lower labor productivity at construction sites in temperate and tropical regions. Another concern is increased costs for countermeasures and accident compensation, due to higher occupational safety risks. There is also a risk of higher shipping costs from a lack of ports if sea levels rise in coastal areas. |

| Products and services | The JGC Group has an extensive record in renewable energy plants such as solar and biomass power plants, which, as the international community shifts toward decarbonization, may increase contract opportunities. The JGC Group has also taken steps to expand orders by establishing an organization dedicated to the promising segment of offshore wind power generation. |

|---|---|

| Oil & gas sector applications of CCS, for which the JGC Group has completed multiple projects in Japan and overseas, and CCUS, for which joint development is underway, are expected to expand contract opportunities. | |

| The JGC Group is engaged in technological development and other initiatives in hydrogen, ammonia, and SMRs applications aimed at a decarbonized society. More contract opportunities here can be expected in the future. | |

| Greater worldwide demand for a circular economy can be expected to drive demand for technologies under development by JGC Group, which include chemical recycling of plastic waste, recycling of fiber waste, and SAF. |

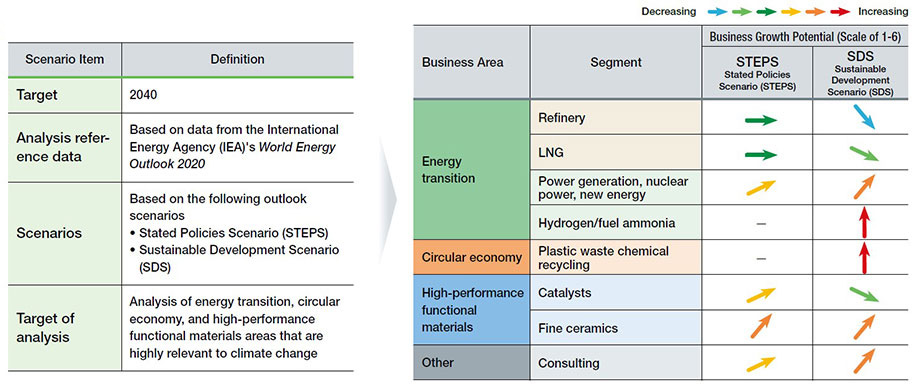

Scenario Analysis

In addition, with the formulation of the climate transition plan in mind, we plan to review the scenario analysis aligned with the 1.5°C target of the Paris Agreement, while taking into account trends such as the revision of the Japanese government’s Basic Energy Plan and the Nationally Determined Contributions (NDC).

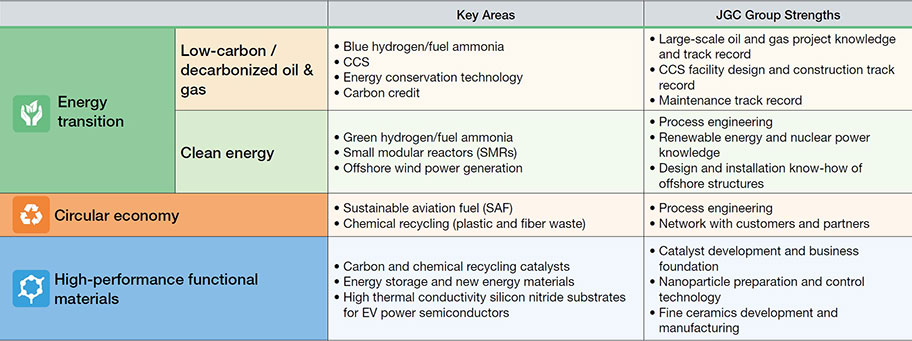

Business areas contributing to achieving societies in harmony with environment (2040 Vision)

Based on a recognition of the above scenarios and the risks and opportunities, the Key Areas listed below of Energy transition, Circular economy and High-performance functional materials in our “2040 Vision” are positioned as business areas that will contribute toward achieving “societies in harmony with environment.”

Using Green Bond to Promote Business to Achieve Societies in Harmony with Environment

On September 19, 2023, the JGC Group issued green bonds totaling \10 billion as a means to raise funds to allocate to new green projects.

We believe that the issuance of these green bonds will provide an opportunity for investors and society to broadly recognize our Group’s commitment to contributing to the creation of economic, social, and environmental value through addressing social issues via our business activities.

Risk Management

The JGC Group is working to reduce and prevent risks from climate change and other factors under a framework that includes the Group Risk Management Committee. (Click here to see our Risk Management.)

Metrics and Targets

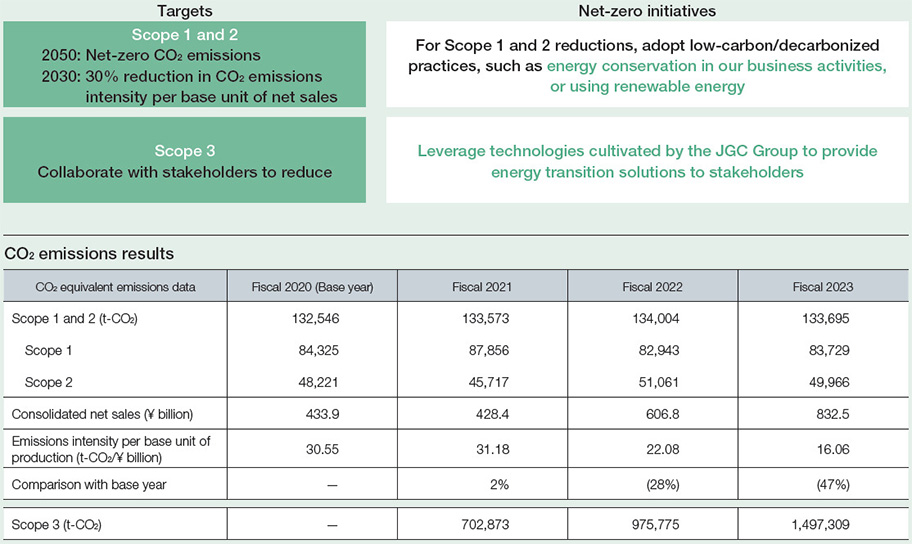

Commitment to Carbon Neutrality by 2050

While the core domain of the JGC Group has long been Oil & Gas, we announced our "Commitment to Carbon Neutrality by 2050" in 2020 as a sign of our dedication to enhancing corporate value in a sustainable manner through transformation toward achieving planetary health.

Targets in the commitment to carbon neutrality by 2050

- ※The Scope 1 and 2 emissions figures were calculated with the aim of identifying the major emitters and amounts within the Group and implementing reduction measures. Total emissions are the sum of emissions independently calculated by the major emitters in the Group, including JGC Holdings Corporation (including JGC Corporate Solutions Co., Ltd.), JGC Corporation, JGC Japan Corporation, JGC Catalysts and Chemicals Ltd., Japan Fine Ceramics Co., Ltd., and Japan NUS Co., Ltd. We will continue to work to improve the reliability of our emissions results through measures such as the establishment of a unified accounting framework for the Group and enhancing comprehensiveness, toward obtaining third-party assurance for this data. For more details on the assumptions and breakdowns within these emission results, please refer to our Group’s response to CDP 2024, an international framework for climate-related information disclosure.

- ※Scope 3 emissions are calculated and reported while excluding Category 11 (use of sold products). In fiscal 2023, emissions increased due to the higher progress rate of in-progress large-scale EPC projects.

Promoting the management and reduction of CO2 emissions

In fiscal 2023, through the CO2 Reduction Planning Subcommittee under the Sustainability Committee, we put in place a policy to organize the Group’s emission forecasts for Scope 1 and 2 by 2030 and established directions for future efforts, and by monitoring the progress of each company’s CO2 reduction plans, to improve the JGC Group’s efforts toward reducing CO2 emissions. As of July 2024, the status of the reduction measures being reviewed or implemented by each company are as follows.

JGC Holdings

Achieving the CO2 reduction targets with 2020 as a baseline year for the Yokohama Office, a key site for our Total Engineering Business that was submitted for participation in the METI’s GX League has required us to purchase non-fossil certificates from fiscal 2023 to make up for the shortfall in achieving a 3% reduction per year.

JGC Corporation

As a part of our reduction strategy at construction site offices and accommodations, we are considering the installation of solar panels and optimizing the operation of temporary compressors used during test runs.

JGC Catalysts and Chemicals

We are promoting a switch to LED lighting and electric forklifts.

Japan Fine Ceramics

We are installing LED lighting, upgrading to highly energy-efficient equipment, and installing solar panels.