Corporate Governance

Basic Stance

The JGC Group positions corporate governance as the foundation of corporate management for achieving sustainable growth, and is working to strengthen it as one of the Group’s material issues.

Regarding the Board of Directors, which is the central body of corporate governance, we are making improvements through continuous review of its composition, functions, and roles, as well as annual evaluations of its effectiveness.

Furthermore, based on our purpose and values, each officer and employee strive to enhance corporate value and achieve sustainable growth while sharing a high sense of ethics, which includes compliance that is essential for proper functioning of corporate governance, and acting with integrity.

Outline of Corporate Governance System

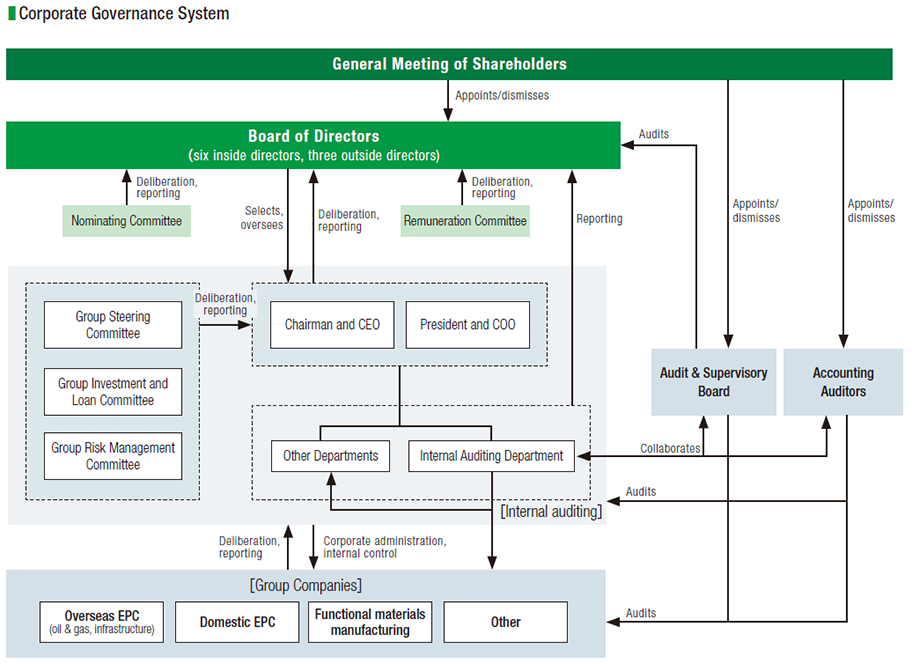

JGC Holdings maintains a board of directors and an audit and supervisory board. The JGC Group has adopted a holding company structure under which operating companies pursue the Group's core business.

Corporate Governance System

JGC Holdings maintains a Board of Directors and an Audit & Supervisory Board. The JGC Group has adopted a holding company structure under which operating companies pursue the Group’s core business.

Separating management from execution provides greater clarity on roles and responsibilities of the holding company and operating companies. The holding company’s role is to formulate management policies and oversee the operating companies from a medium- to long-term Group perspective. Operating companies apply Group management policies and strategies to respond flexibly and rapidly to market characteristics and seek further business expansion. This is intended to maximize corporate value and ensure optimal allocation of management resources for the Group as a whole while enhancing transparency of corporate management and strengthening overall Group governance. Committees have been established to deliberate key Group matters, and an executive officer system has been introduced to ensure efficient managerial decision-making and execution.

- *CPAs Atsushi Nagata, Otoko Sekiguchi, and Takashi Inoue of KPMG AZSA LLC performed accounting audit services.

Audit support staff consisted of 10 CPAs and 18 other individuals.

| Body | Purpose |

|---|---|

| ① Board of Directors |

|

| ② Nominating and Remuneration Committees |

|

| ③ Audit & Supervisory Board |

|

| Name | Members | Overview |

|---|---|---|

| Group Steering Committee In principle, once a month |

Chairman (Representative Director, Chairman and President of the Board) and members (including auditors attending on a rotating basis): Total 30 members | Reports on and discusses the direction that the Group should take as well as steering matters such as management / business strategies for the Group as a whole and each operating company |

| Sustainability Committee In principle, three times |

Chairman (Representative Director, Chairman and President of the Board) and committee members: 7 members | Formulates Group policies and action plans related to sustainability; deliberation to evaluate and promote action supporting sustainability |

| Group Investment and Loan Committee In principle, once a month |

Chairman (Representative Director, Chairman and President of the Board), Vice Chairman, and committee members: Total 10 members | Deliberates on holding company and Group investment and lending projects |

| Group Risk Management Committee In principle, twice a year |

Chairman (Representative Director and Senior Executive Vice President), Vice Chairman, and committee members: Total 13 members | Understands and organizes all risks of the Group, and regularly reports and deliberates on the construction, maintenance, and improvement of the Group-wide risk management system |

| Group Information Security Committee In principle, twice a year |

Chairman (Representative Director and Senior Executive Vice President), Vice Chairman, and committee members: Total 14 members | Understands the status of information security measures across the Group as a whole, and plans and discusses cross-organizational adjustments and enhanced responses among Group companies |

| Name | Overview |

|---|---|

| Economic Security and Geopolitical Risk Review Task Force |

Collecting and analyzing information on risks related to changes in the macroeconomic environment and social and international conditions across the Group, and sharing with stakeholders, etc. |

- *Amidst unstable international conditions, the importance of responding to economic security and geopolitical risks within our Group has increased, and in fiscal year 2023, we established an Economic Security and Geopolitical Risk Task Force.

Through this task force, we conduct cross-Group research and analysis of various trends and impacts, and focus on risk management.

Improvement Status of Internal Control System

JGC Holdings' Board of Directors determines the basic principles of the internal control system and revises them as necessary.

【Improvement Status】

- 1.The Internal Auditing Department monitors, evaluates, and improves the effectiveness of the internal control systems of JGC Holdings and the JGC Group and conducts separate audits as necessary

- 2.Rules of Management Authority regulate the duties and authority of each role, and clarify the system of responsibilities in corporate management and business execution

- 3.Management rules for Group companies have been formulated and implemented to ensure efficient and appropriate operations across the Group

About JGC's Response to the Corporate Governance Code

We implement all principles stipulated in the revised Corporate Governance Code of June 11, 2021, and disclose all 14 basic principles, principles, and supplementary principles required by the Tokyo Stock Exchange. We are steadily advancing various initiatives to further deepen our Message from the Chairman and CEO.

Board of Directors

Board Functions

The Board of Directors is responsible for decision-making on medium- to long-term Group strategy and issues, and it provides oversight regarding business execution of Group companies. Board composition is intended to enable effective and efficient execution of these functions.

Basic Policy on Board Composition and Diversity

From the standpoint of further enhancing discussions on medium- to longterm group strategies and issues and of strengthening oversight regarding business execution of the Group companies, the Board consists of the following members.

- 1.Mainly composed of directors with extensive knowledge of business markets and directors with advanced knowledge and expertise in EPC business operations, which is the Group’s core business.

- 2.To incorporate external perspectives into management, independent Outside Directors are appointed with the expectation that they will provide objective advice to the Board of Directors and fulfill oversight functions from an independent standpoint.

As a matter of policy respecting the importance of diverse perspectives, members are appointed not solely based on professional experience and expertise but also on competence, regardless of nationality, race, or gender.

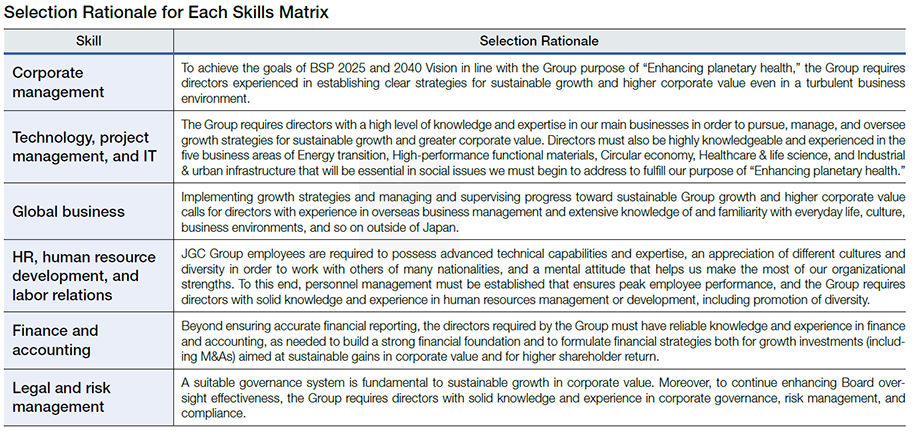

Skills Matrix for Directors and Auditors

Skills Matrix of Directors (Four inside, four outside)

| Name and position at JGC | Term as director (years) |

Attendance at Board meetings in fiscal year 2024 |

Segment | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate management |

Technology, project management, and IT |

Global business |

HR, human resource development, and labor relations |

Finance and accounting |

Legal and risk management |

|||

| Masayuki Sato Representative Director, Chairman, President, and CEO |

15 | 17/17 times (100 %) |

〇 | 〇 | 〇 | |||

| Kiyotaka Terajima Representative Director and Senior Executive Vice President and CFO |

9 | 17/17 times (100 %) |

〇 | 〇 | 〇 | |||

| Masaki Ishikawa*1 Director and Senior Executive Officer |

1 | 12/12 times (100 %) |

〇 | 〇 | 〇 | |||

| Shoji Yamada Directors |

4 | 16/17 times (94 %) |

〇 | 〇 | 〇 | |||

| Masayuki Matsushima Outside Director |

9 | 17/17 times (100 %) |

〇 | 〇 | 〇 | |||

| Noriko Yao Outside Director |

4 | 17/17 times (100 %) |

〇 | 〇 | 〇 | |||

| Shinjiro Mishima*1 Outside Director |

1 | 12/12 times (100 %) |

〇 | 〇 | 〇 | |||

| Miku Hirano*1 Outside Director |

1 | 12/12 times (100 %) |

〇 | 〇 | 〇 | |||

- *1As the appointment took effect on June 27, 2024, the attendance at Board of Directors meetings held after June 27, 2024 is listed.

Skills Matrix of Auditors (Two inside, three outside)

| Name and position at JGC | Term as auditor (years) |

Attendance at Board meetings in fiscal year 2024 |

Segment | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate management |

Technology, project management, and IT |

Global business |

HR, human resource Development, and labor relations |

Finance and accounting |

Legal and risk management |

|||

| Kazuyoshi Muto Audit and Supervisory Board Member |

4 | 17/17 times (100 %) |

〇 | 〇 | 〇 | |||

| Akira Ninomiya*2 Audit and Supervisory Board Member |

1 | 12/12 times (100 %) |

〇 | 〇 | 〇 | |||

| Norio Takamatsu Outside Audit & Supervisory Board Member |

9 | 17/17 times (100 %) |

〇 | 〇 | 〇 | |||

| Kazuya Oki Outside Audit & Supervisory Board Member |

2 | 16/17 times (94 %) |

〇 | 〇 | 〇 | |||

| Norio Funayama*2 Outside Audit & Supervisory Board Member |

1 | 12/12 times (100 %) |

〇 | 〇 | 〇 | |||

- *2 As the appointment took effect on June 27, 2024, the attendance at Board of Directors meetings held after June 27, 2024 is listed.

(Note 1) This pertains to officers as of after the Annual General Meeting of Shareholders held on June 27, 2025.

(Note 2) The above list indicates the areas where each individual can best demonstrate their expertise based on their experience, and does not represent all the knowledge and experience possessed by each director and auditor. In addition, ESG-related fields are positioned as an expected role required of all directors and auditors, and are therefore not listed as a separate item in the above table.

| Theme | Main agenda and deliberation items |

|---|---|

| Management strategy, governance, and sustainability |

|

| Financial results, finance, HR, and organization |

|

| Individual businesses |

|

Proportion of deliberation time spent on each item at Board of Directors meetings

Policies and Procedures for Senior Management Appointment and Dismissal

Appointment process

Appointment of senior management and nomination of candidates for directors

- 1.Deliberations of the Nomination Committee, which consists of a majority of outside directors and is chaired by an outside director, are focused on the following items.

- (1)Qualities such as character and views

- (2)Senior management and inside directors: Qualities such as experience, performance, and management capabilities, as defined in succession planning

- (3)Outside directors: Qualities such as independence and expertise

- 2.After comprehensive deliberation by the Nominating Committee, decisions are made by the Board of Directors.

In addition, regarding the appointment of senior management and nomination of director candidates, it is recognized that these individuals may become successors to the CEO, and sufficient discussion and selection are conducted through the above process.

Dismissal process

Dismissal of senior management

In the event of any of the following, the Board decides on dismissal after deliberation by the Nominating Committee.

- (1)Wrongdoing, impropriety, or breach of faith

- (2)Violation of laws or articles of incorporation

- (3)Loss of the qualities and capabilities initially required for appointment

Succession plan

The succession plan is a crucial matter for the sustainable enhancement of corporate value. Based on discussions in the Nominating Committee and the Board of Directors, we have started implementing the succession plan as follows.

Purpose

- To realize “BSP 2025” and the “2040 Vision,” and to continuously enhance corporate value beyond that, we recognize that it is essential to appoint top management best suited to the business environment and management strategies of the time.

- The succession plan aims to clarify the knowledge, experience, abilities, and qualities required of top management based on the business environment and management strategies, and to support the development and selection of the next top management, enabling continuous appointment of such leaders.

Stance on leadership criteria

- In setting the criteria for talent, in fiscal year 2019, interviews with top management were conducted through a third-party organization, starting from a medium- to long-term management vision, and the future profile of required management talent was defined.

- For each extracted talent requirement, criteria are classified into “Must requirements that should be acquired at the stage of selection for each candidate group” and “Want requirements that are desirable to be acquired at the stage of selection for each candidate group (three levels) ,” and the required degree is set for each candidate group.

Stance on succession planning

- The basic concept of our succession plan is to define the requirements for top management personnel, select multiple candidates for the next and future generations, provide opportunities to fulfill any lacking requirements and gain experience, and foster top management candidates over the medium to long term by monitoring their development annually. We have begun operating under this approach.

- Based on the above concept, we are implementing various measures to further strengthen and expand the development program for future candidate groups, such as sending candidates to external education and training programs, holding regular lectures by inviting external instructors, and providing opportunities for ongoing discussions.

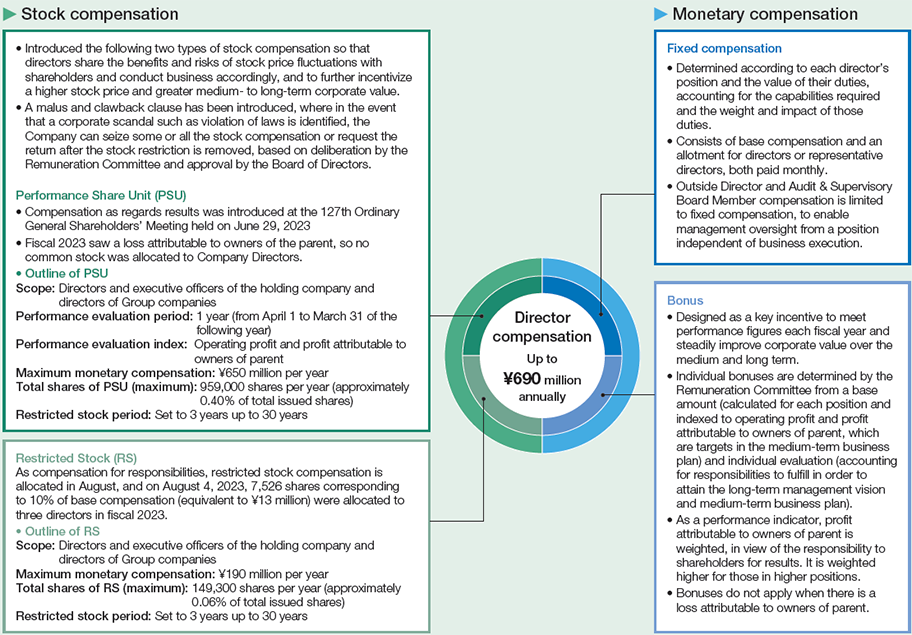

Director Compensation

Policy on determining director compensation amounts or calculation methods

Basic policy, General Shareholders’ Meeting resolutions

- With the basic policy of securing the management personnel necessary to enhance global competitiveness and increase corporate value over the medium to long term, the resolution at the 113th Annual General Shareholders’ Meeting held on June 26, 2009, set the maximum annual compensation at up to \690 million for directors and up to \88 million for auditors.

- The policy for determining the amount, calculation method, and composition ratio of individual directors’ compensation is limited to the scope resolved at the above General Shareholders’ Meeting. In advance, the Remuneration Committee, which consists of a majority of Outside Directors and is chaired by an Outside Director, deliberates on these matters, and the Board of Directors makes decisions based on the committee’s report.

Process for determining compensation

- To ensure sufficient fairness, transparency, and consistency with this decision policy, the Remuneration Committee comprehensively deliberates on the evaluation and remuneration amount for each director, and the Representative Director, Chairman and President makes the final decision based on the results of these deliberations.

- The Representative Director, Chairman and President of the Board of Directors, as the Company’s Chief Executive Officer, is the person most familiar with each director’s duties, responsibilities, performance, and the degree to which such performance contributes to enhancing corporate value. The President is delegated this authority by the Board of Directors, and such authority is limited to the range of compensation set by resolution of the General Shareholders’ Meeting.

- The Board of Directors determines that the final decisions are consistent with this policy, and in making this determination, receives reports on the summary and results of deliberations by the Remuneration Committee, as well as the final decisions made by the Representative Director, Chairman and President of the Board of Directors.

Compensation mix and details

- Compensation for directors, excluding Outside Directors, consists of monetary compensation and stock compensation. Monetary compensation comprises fixed compensation and bonuses, while stock compensation consists of non-performancelinked stock compensation and performance-linked stock compensation.

- The compensation mix is designed so that the proportion of variable compensation, which includes bonuses and stock compensation, increases with higher performance and rank.

Breakdown of Executive Remuneration

| Category | Total value of compensation, etc. |

Breakdown of compensation, etc. | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Fixed compensation | Performance-based compensation (monetary) |

Restricted stock | Performance share unit | ||||||

| Number of eligible executives |

Total amount provided |

Number of eligible Executives |

Total amount provided |

Number of Eligible executives |

Total amount provided |

Number of Eligible Executives |

Total amount provided |

||

| Directors: 5 (excluding outside directors) |

213 million yen | 5 | 197 million yen | – | – | 4 | 16 million yen | – | – |

| Auditors: 3 (excluding outside auditors) |

41 million yen | 3 | 41 million yen | – | – | – | – | – | – |

| Nine outside officers (five outside directors and four Outside Audit & Supervisory Board members) |

93 million yen | 9 | 93 million yen | – | – | – | – | – | – |

(Notes)

- 1As of the end of fiscal year 2024, there were 10 directors (including five Outside Directors) and five auditors (including three outside auditors) .

- 2The performance-based compensation (monetary) and performance share unit above did not achieve the performance evaluation indicators, and so were not granted.

- 3Since our Company has no executives with total remuneration of \100 million or more, individual compensation is not disclosed.

Board Effectiveness Evaluation

Board effectiveness is analyzed and evaluated annually, efforts toward improvement are reviewed, and issues linked to further gains in effectiveness are discussed by the Board in pursuit of continuous improvement. Presented below is a summary of the process for evaluating Board effectiveness in fiscal year 2024, the state of initiatives based on the Board evaluation results of the previous year (fiscal year 2023) , and future response policy based on these evaluation results.

| Target | Directors and auditors |

|---|---|

| Response Method |

Five-point scale selection and free-form responses (Total 38 of questions) |

| Main evaluation items | Board of Directors composition, management, discussion, oversight functions, dialogue with shareholders, own initiatives, operation of the Nominating Committee and Remuneration Committee, etc. |

Evaluation results

Survey analysis and evaluation has indicated that the Board is functioning appropriately and effectively in its current state. Details of the evaluation results are as follows.

| 1 | Issues identified during FY2023 | ① Further deepening discussions in the Board of Directors on the Group’s medium- to long-term growth and enhancement of corporate value ② Deepening discussions and strengthening monitoring of business execution by the Board of Directors |

|---|---|---|

| Main initiatives FY2024 | • To facilitate planned discussions on medium- to long-term growth and enhancement of corporate value, an annual agenda schedule for the Board of Directors was formulated • Revised submission material format to expand descriptions of the significance and risk analysis of initiatives based on the medium- to long-term management plan • On-site visit to the LNG Canada Project by Outside Directors |

|

| 2 | Results of analysis and evaluation for the FY2024 | • Confirmed that our Board of Directors is currently functioning appropriately and effectively • It was confirmed that, as FY2025 is the final year of the current medium-term management plan and discussions on the next plan will be in full swing, and considering the role the Board of Directors should play in terms of overall group management and medium- to long-term perspectives, efforts to address the issues set for FY2024 will be continued • In addition, recognizing the importance of free and constructive discussions at the Board of Directors based on effective Board operations, it was confirmed that further improvements to Board operations, including prebriefings and study sessions, will be considered |

| Key issues to be addressed as priorities in FY2025 | ① [Continued from fiscal year 2024] Further deepening discussions in the Board of Directors on the Group’s medium- to long-term growth and enhancement of corporate value: As measures for this, the following opinions were put forward. • In discussions on formulating the next medium-term management plan, sufficient time will be secured by utilizing not only the Board of Directors but also informal settings such as study sessions, and after reviewing the current plan, discussions on the business portfolio from the perspective of enhancing the corporate value of the entire Group will be conducted ② [Continued from fiscal year 2024] Deepening discussions and strengthening monitoring of business execution by the Board of Directors: As measures for this, the following opinions were put forward. • Enhance explanations regarding the positioning of businesses within overall Group management and their potential impact on the Group as a whole, and conduct discussions and monitoring based on these explanations • Continue to consider the content and methods of reports from the Nominating and Remuneration Committees to the Board of Directors ③ Further consideration of improvements in operations of the Board of Directors: As measures for this, the following opinions were put forward. • Re-examine the selection of agenda items and methods for pre-briefings from the perspective of efficient operations |

- *For initiatives to improve the effectiveness of the Board of Directors over the past three years, please refer to JGC Report 2024[PDF:11.4MB] P.84.

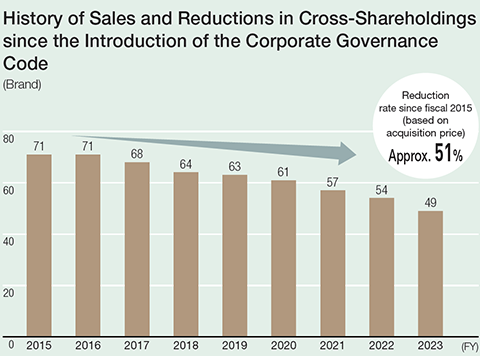

Policy-held Shares

1. Purpose

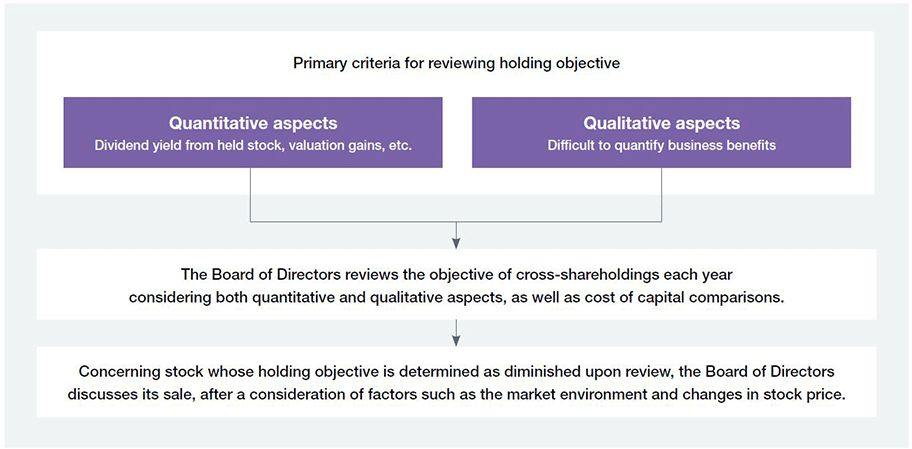

The Group refrains from cross-shareholdings except in cases where maintaining and strengthening relationships with clients and business partners will contribute to higher medium- to long-term corporate value for the Group. Each year, the Board of Directors reviews the significance of maintaining each cross-shareholding, and both qualitative and quantitative aspects are reviewed. Quantitatively, TSR (total shareholder return) and ROE are checked for each company, as well as whether business advantages are commensurate with the cost of equity. Sale of shares deemed to have lost their significance is investigated accounting for the market environment and changes in stock prices.

2. Basis for exercising voting rights

In exercising voting rights for cross-shareholdings, advantages and disadvantages are weighed based on whether the decision will contribute to sustained growth of the company involved, and thus, higher Group corporate value over the medium to long term.

Messages from Outside Directors

For the message from our Outside Directors, please refer to JGC Report 2025[PDF:312KB] P.83-85.